Pepe (PEPE) is sending strong bearish signals, as the frog-themed meme coin faces a potential 28% drop in value. Trading within a falling wedge pattern since May 27, PEPE has already seen its value plummet by 52%, and all signs point to further decline. Currently priced at $0.0000077, this meme coin is on a downward trajectory that could continue to impact investors.

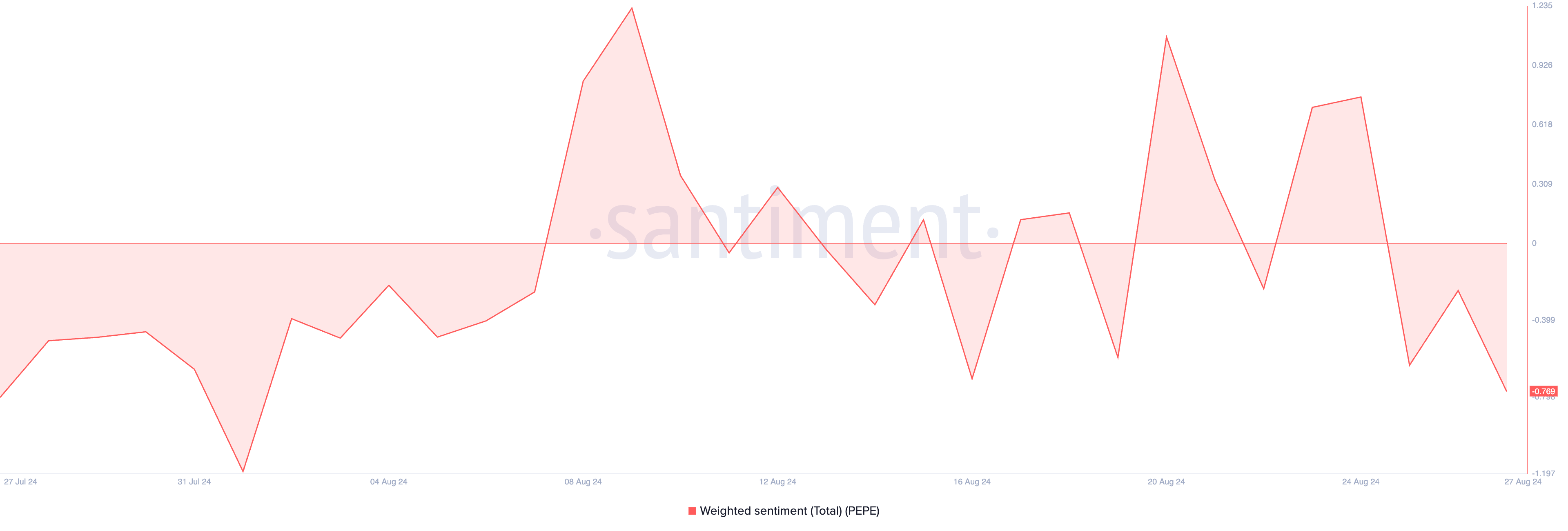

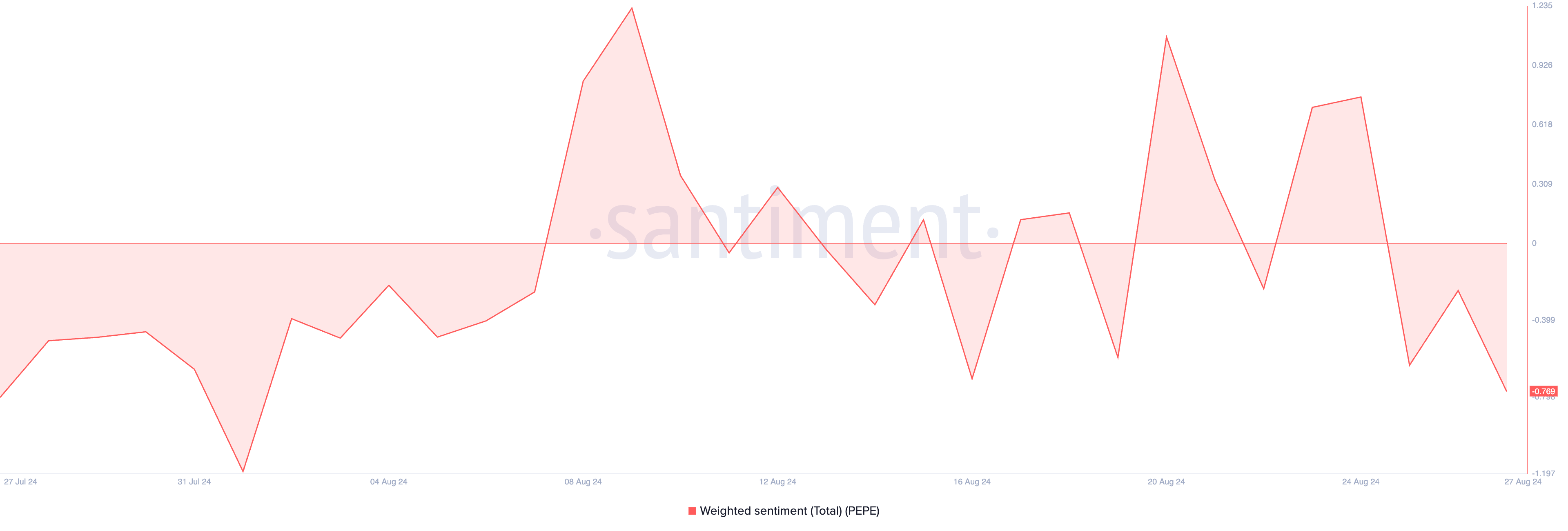

PEPE Weighted Sentiment. Source: Santiment

PEPE Weighted Sentiment. Source: Santiment

The “Pepe bearish signals” are becoming more evident as the price approaches the lower trendline of its falling wedge pattern, a situation that typically indicates a continuation of the existing downtrend. These bearish signals have caused significant concern within the crypto community, leading experts to speculate about PEPE’s future.

Bearish Trend Intensifies for PEPE – Pepe Bearish Signals

Pepe bearish signals have been observed ever since the coin started trading within a falling wedge pattern, a technical setup that has historically indicated a potential reversal. However, in PEPE’s case, the situation appears to be different. Since August 25, the meme coin has dropped by another 15%, further pushing its price towards the lower line of the wedge. The fact that PEPE has failed to break out of this pattern suggests that the bearish signals could lead to a more prolonged downtrend.

As technical analyst Michael Van de Poppe notes, “PEPE’s current price action is a classic example of a meme coin struggling under market pressure. The persistent downtrend within the falling wedge pattern is a clear indicator that investors are losing confidence, and this could lead to further significant declines.”

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

A falling wedge pattern occurs when an asset’s price fluctuates between two downward-sloping trendlines. In most cases, this pattern is considered bullish, as it often precedes a breakout above the upper trendline, leading to a significant upward movement. However, Pepe bearish signals suggest that this pattern may not play out in PEPE’s favor.

“Falling wedges are typically seen as bullish, but the key factor here is where the price is heading within the wedge,” explains Sarah Zucker, a cryptocurrency technical analyst. “If PEPE’s price breaks below the lower trendline, it invalidates the bullish outlook and confirms the bearish signals we’re seeing right now.”

Pepe Bearish Signals and Technical Indicators

The bearish signals for PEPE are further corroborated by its technical indicators. The meme coin is currently trading below key moving averages, specifically its 20-day exponential moving average (EMA) and 50-day simple moving average (SMA). These indicators are crucial for understanding an asset’s momentum, and in PEPE’s case, they paint a grim picture.

“The 20-day EMA and 50-day SMA are vital indicators of market sentiment,” says Luke Martin, a crypto market analyst. “When an asset’s price is below these averages, it signals weakening momentum and increasing selling pressure. For PEPE, this means that even if there’s a short-term rally, these moving averages will likely act as resistance, reinforcing the bearish signals.”

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

Given the current technical setup and prevailing market sentiment, experts believe that PEPE could face a further 28% drop. This decline would bring its price closer to the $0.0000055 level, a scenario that has many investors on edge.

“Pepe bearish signals are strong, and with the price nearing the lower trendline of the falling wedge, a 28% drop is highly plausible,” says crypto analyst John Isige. “If PEPE does break below this trendline, it could trigger a wave of panic selling, driving the price even lower.”

Investors Brace for Impact And What Lies Ahead of PEPE – Pepe Bearish Signals

With Pepe bearish signals intensifying, investors are bracing for further losses. The ongoing downtrend has already wiped out a significant portion of PEPE’s value, and the prospect of an additional 28% drop has many questioning the long-term viability of this meme coin.

“PEPE’s performance is a reminder of the risks associated with meme coins,” cautions Clara Medici, a financial analyst specializing in cryptocurrencies. “While the initial hype can drive prices up, sustained value is often hard to maintain, especially when technical indicators are flashing bearish signals.”

The outlook for PEPE remains uncertain as bearish signals dominate the narrative. If the meme coin breaks below the lower trendline of its falling wedge pattern, it could spell disaster for investors. However, if it manages to hold this support level and reverse course, there may be some hope for a recovery.

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

In conclusion, the “Pepe bearish signals” present a challenging scenario for PEPE holders. The coin’s price action, technical indicators, and overall market sentiment suggest that a further decline is likely. As the crypto market continues to evolve, investors will need to stay vigilant and carefully monitor these bearish signals to navigate the uncertain waters ahead. The Bit Gazette has the latest crypto news and expert analysis.

PEPE Weighted Sentiment. Source:

PEPE Weighted Sentiment. Source:  PEPE Price Analysis. Source:

PEPE Price Analysis. Source:  PEPE Price Analysis. Source:

PEPE Price Analysis. Source: