AAVE whales have injected a massive $12 million into the AAVE token following a 40% price rally over the past week, drawing significant attention in the decentralized finance (DeFi) sector. This surge in AAVE whales activities has sparked widespread speculation among traders and analysts, who are closely watching the potential impact on AAVE’s future performance. The substantial investment by large holders highlights the growing interest and confidence in AAVE, raising questions about how this influx of capital might influence the token’s trajectory in the rapidly evolving DeFi landscape.

Whale Accumulation Drives AAVE Price Surge

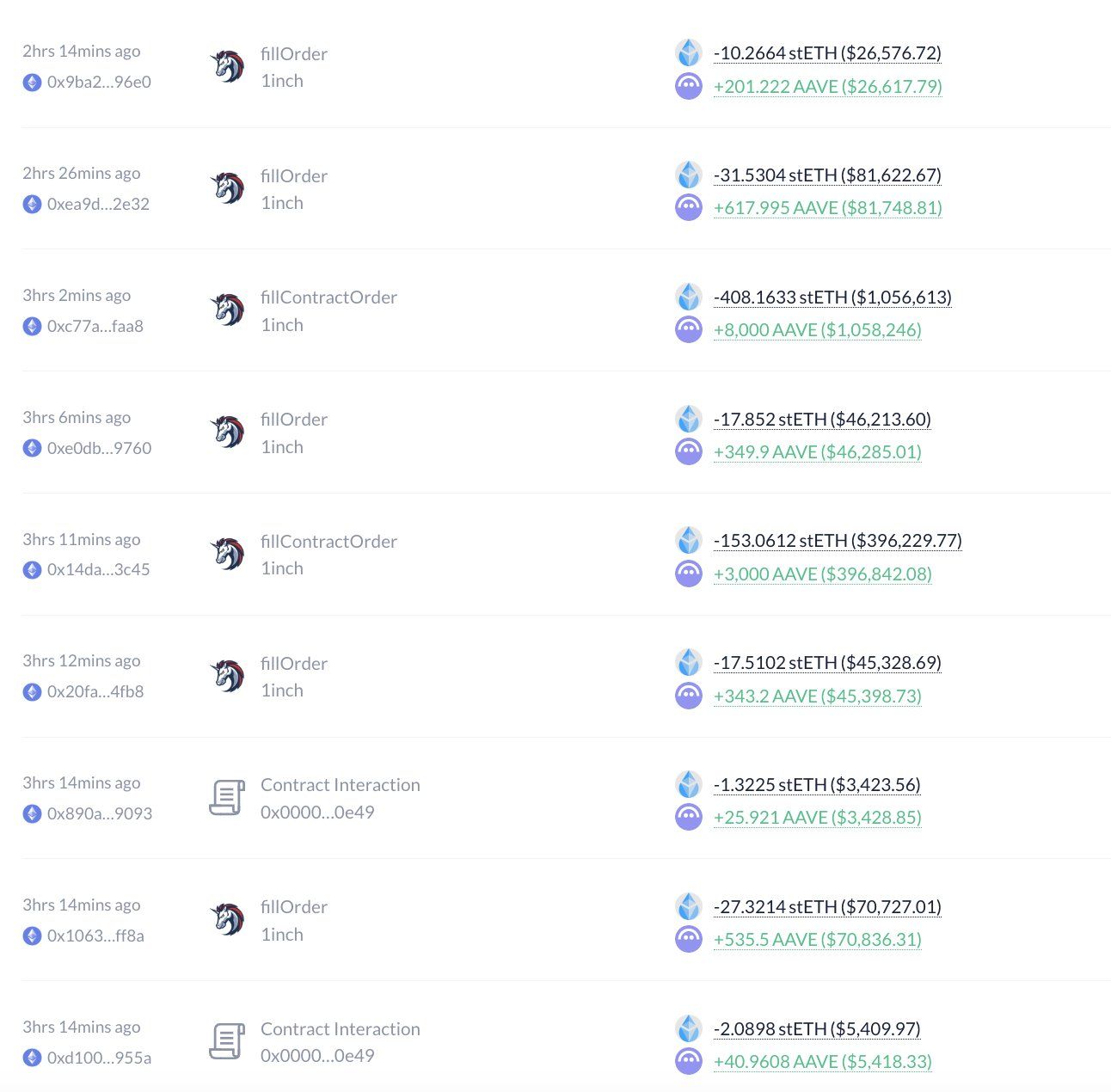

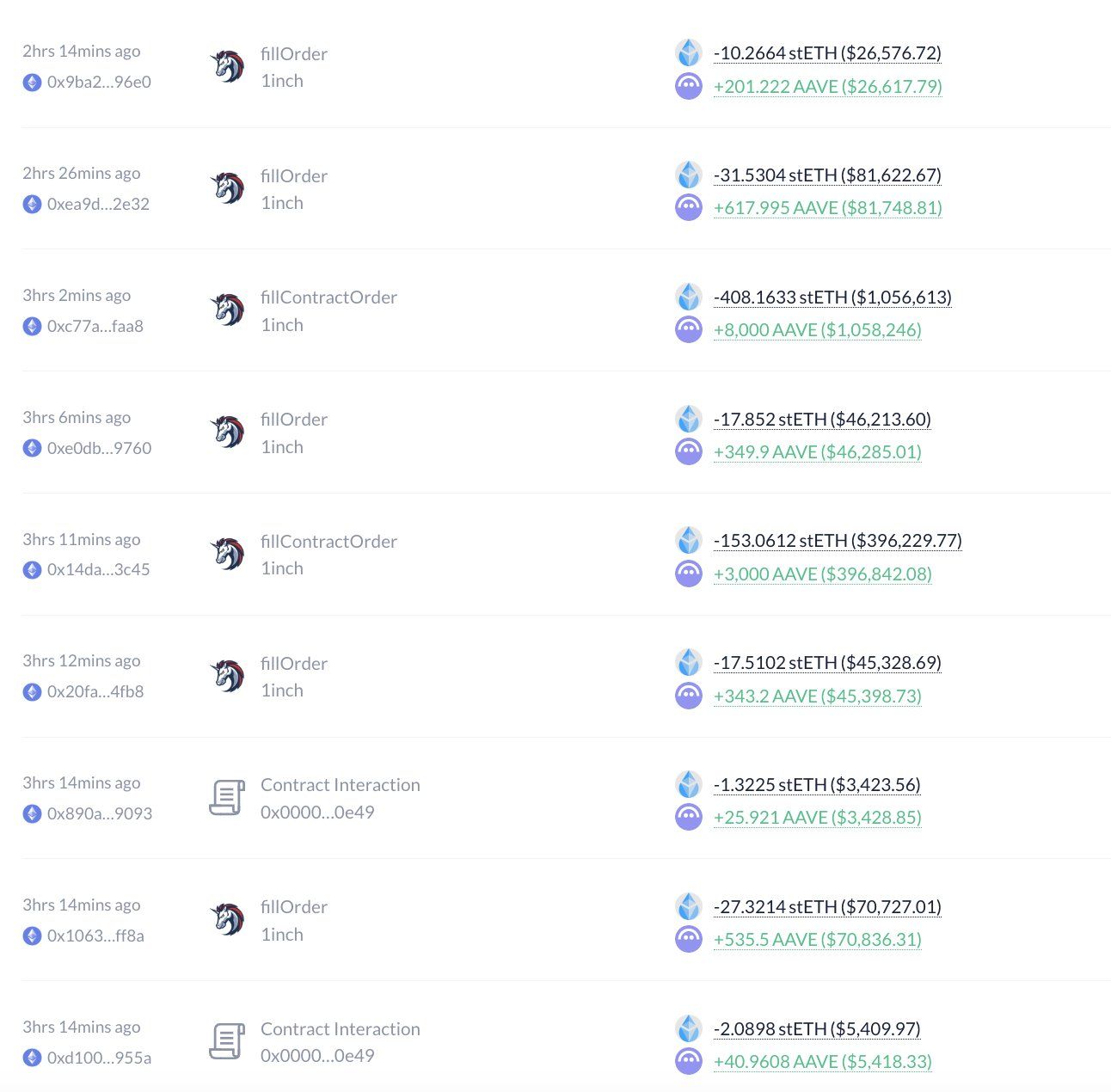

AAVE whales activities are not just making waves; they’re creating a tsunami in the crypto market. The accumulation spree by these crypto giants began in earnest on August 21, when a whale purchased over 50,000 AAVE tokens, valued at $6.65 million. Just hours earlier, another significant player in the market had already snapped up 11,101 tokens, worth approximately $1.45 million.

Crypto whales can greatly influence prices by buying tokens in large quantities. For example, if whales dump a large amount of cryptocurrency, the price often drops.

Crypto Whales Accumulation. Source: Lookonchain

Crypto Whales Accumulation. Source: Lookonchain

This influx of capital from AAVE whales is a clear signal of confidence in the token’s potential. Historically, when whales accumulate large quantities of a cryptocurrency, it puts upward pressure on prices, often leading to further rallies. In AAVE’s case, the total accumulation over two days reached $12.02 million, a figure that is likely to push the token’s value even higher.

Market Dynamics: The Role of Whale Activity

The activities of AAVE whales are crucial in understanding the token’s price movements. When whales buy in large quantities, they can significantly influence the market, either by driving prices up through accumulation or causing sharp declines by offloading their holdings. In the current scenario, the bullish actions of these whales have already contributed to AAVE outperforming other top altcoins.

Aave Weekly Analysis. Source: TradingView

Aave Weekly Analysis. Source: TradingView

AAVE’s price, which recently hit $137.93, has not only risen sharply but has also maintained this momentum, suggesting that the whales’ buying spree may not just be a short-term play. The sustained accumulation by these market participants indicates a longer-term bullish outlook, which could see AAVE testing higher resistance levels in the near future.

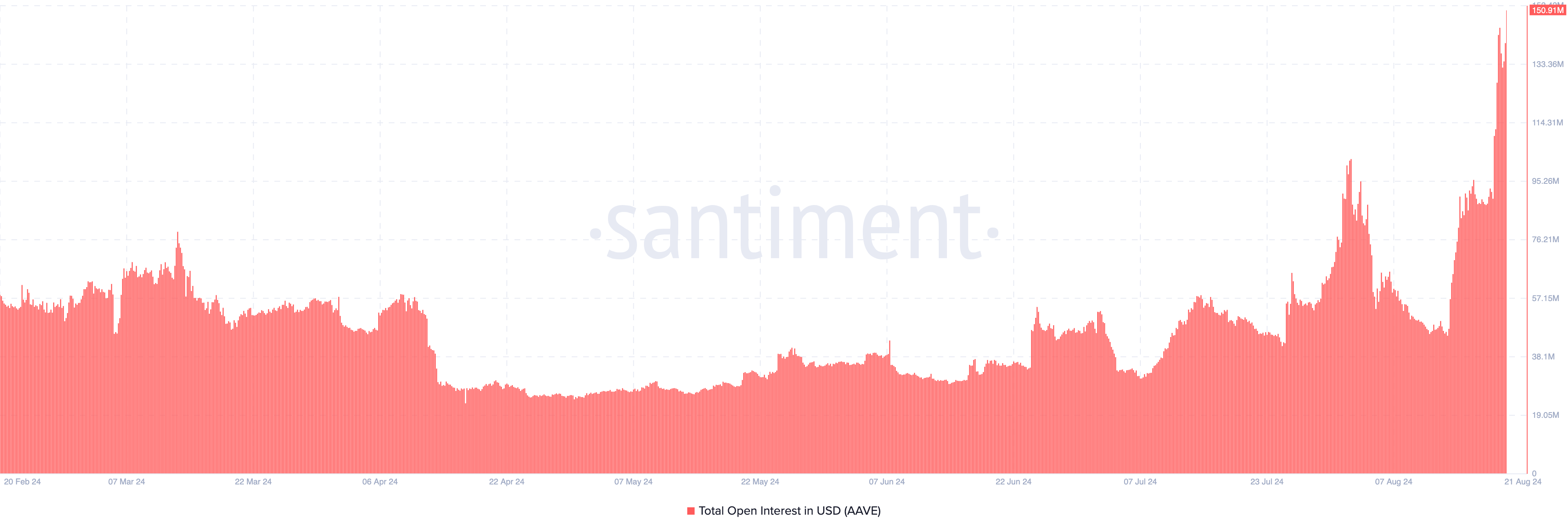

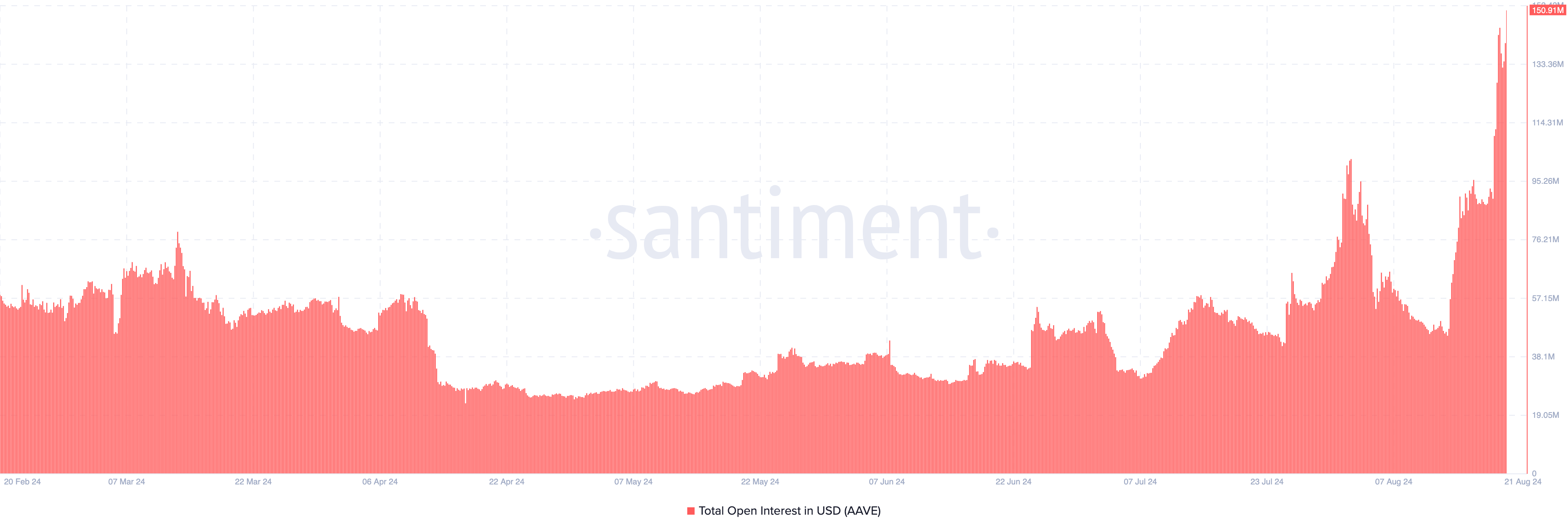

Adding to the bullish sentiment surrounding AAVE whales activities is the surge in Open Interest (OI) for AAVE-related contracts. Since August 13, OI has skyrocketed from below $45 million to an impressive $153.94 million, marking the highest level since August 2023. This surge in OI reflects a growing interest among traders in AAVE, further amplifying the bullish momentum.

Open Interest represents the total of all open contracts in the derivatives market. A rising OI typically signals that traders are committing more capital to the asset, which can lead to further price increases if the spot market doesn’t offset this buying pressure. In AAVE’s case, the confluence of rising OI and whale accumulation suggests a robust market outlook, with potential for continued price appreciation.

Expert Insights: What the Analysts Are Saying

Market analysts are taking note of AAVE whales activities and their potential impact on the token’s future. According to a recent report by BeInCrypto, AAVE has successfully broken out of a two-year accumulation range between $112 and $130, a significant technical milestone that could pave the way for further gains.

Aave Daily Analysis. Source: TradingView

Aave Daily Analysis. Source: TradingView

“AAVE’s breakout from this prolonged accumulation range is a strong bullish signal,” says crypto analyst Sarah McMahon. “With whale accumulation and rising Open Interest, we could see AAVE challenge the $280 level by late 2024 or early 2025, provided the broader market remains supportive.”

Another notable observation comes from Lookonchain, which highlighted the recent whale purchases as a catalyst for the token’s upward trajectory. “The recent buying spree by AAVE whales is a clear indication of confidence in the token’s future prospects. As long as these whales continue to accumulate, we can expect sustained upward pressure on AAVE’s price.”

Price Prediction: What’s Next for AAVE?

Despite the recent rally, AAVE remains down 79% from its all-time high, leaving plenty of room for further upside. With the support level at $91.04 holding firm and significant buying pressure helping to break past the $106.70 resistance, the stage is set for potential higher gains.

Technical indicators, such as the On Balance Volume (OBV), are also pointing to a bullish outlook. The rising OBV suggests that buying volume is outpacing selling volume, further supporting the case for a continued price increase.

Aave Open Interest. Source: Santiment

Aave Open Interest. Source: Santiment

If the current trends continue, AAVE could see its price climb towards the $280 mark in the next cycle, making it one of the most promising tokens in the DeFi space.

AAVE Whales Activities Signal Bullish Future

The recent surge in AAVE whales activities is a clear bullish signal for the token’s future. With $12 million in new capital flowing into AAVE, coupled with rising Open Interest and positive technical indicators, the outlook for AAVE appears strong. As these whales continue to accumulate, the potential for further price increases grows, making AAVE a token to watch in the coming months. The Bit Gazettehas the latest crypto news and expert analysis.

Crypto Whales Accumulation. Source:

Crypto Whales Accumulation. Source:  Aave Weekly Analysis. Source:

Aave Weekly Analysis. Source:  Aave Daily Analysis. Source:

Aave Daily Analysis. Source:  Aave Open Interest. Source:

Aave Open Interest. Source: