BlackRock's Bitcoin ETF Faces September Slump With $7 Million Price Surge

BlackRock’s Bitcoin ETF saw a less-than-impressive performance in September despite Bitcoin prices experiencing a modest increase. BlackRock’s iShares Bitcoin Trust (IBIT) managed to secure only $6.76 million in net inflows, raising eyebrows within the crypto investment community. For a fund that has often been in the spotlight, this subdued inflow amid Bitcoin’s nearly 5% price increase signaled a unique market hesitancy.

While BlackRock’s Bitcoin ETF is still regarded as a trailblazer in bringing institutional-grade Bitcoin exposure to investors, its September performance suggests that broader market conditions are affecting fund inflows.

Mixed Inflows and Outflows for BlackRock’s Bitcoin ETF

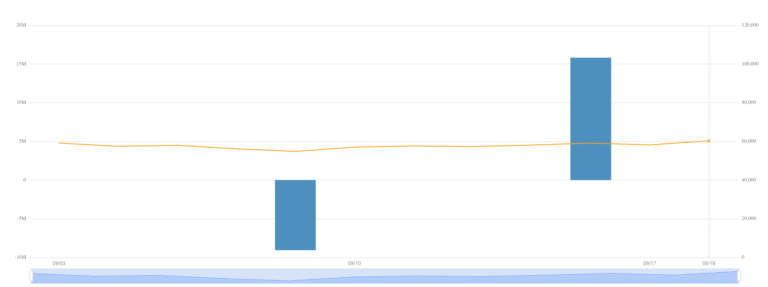

The month began optimistically for BlackRock’s Bitcoin ETF, with a notable inflow of $15.82 million on September 16. However, the gains were quickly negated by an outflow of $9.06 million earlier in the month, resulting in the month closing out with a modest net inflow of $6.76 million. Ten out of the 20 trading days in September saw zero netflow, further highlighting the stagnation of interest in BlackRock’s flagship crypto fund.

Despite these struggles, BlackRock’s Bitcoin ETF continues to be one of the few funds to maintain relatively stable inflows during the turbulent Bitcoin market.

The sluggish performance of BlackRock’s Bitcoin ETF wasn’t an isolated incident. September recorded a collective outflow of around $155.30 million from all spot Bitcoin ETFs, indicating that market uncertainty is prevalent. With crypto prices fluctuating and regulatory frameworks still under scrutiny, many investors seem hesitant to jump into Bitcoin ETFs.

Still, BlackRock’s Bitcoin ETF stands out in its ability to attract inflows, albeit minimal, when many other funds saw substantial outflows.

BlackRock’s Bitcoin ETF: BlackRock’s Report

Amid this market volatility, BlackRock released an in-depth report titled, “Bitcoin: A Unique Diversifier,” which delves into Bitcoin’s attributes as a crucial diversification tool. According to the report, Bitcoin’s scarcity, decentralization, and global reach make it a compelling asset that stands apart from traditional financial assets.

BlackRock’s analysis emphasized how Bitcoin performed remarkably well compared to major asset classes, outperforming them in seven of the last ten years with annual returns exceeding 100%. The report also acknowledged Bitcoin’s volatility, with the cryptocurrency experiencing four drawdowns of over 50% during that time.

However, BlackRock’s Bitcoin ETF is backed by the belief that Bitcoin’s ability to recover from sharp declines makes it an essential hedge against traditional financial uncertainties.

Bitcoin has consistently demonstrated resilience, often recovering from its bear cycles to reach new all-time highs,” said Marcus Collins, a senior analyst at BlackRock. “For long-term investors, Bitcoin presents an exciting opportunity to diversify portfolios in the face of global economic and geopolitical uncertainties.”

In its report, BlackRock emphasized how Bitcoin has become an attractive safe haven asset during periods of economic turmoil. As the world faces rising federal deficits, geopolitical tensions, and concerns over central bank policies, BlackRock’s Bitcoin ETF offers an alternative to traditional asset classes that may be more exposed to these risks.

Additionally, BlackRock underscored Bitcoin’s non-sovereign and decentralized nature, which shields it from the financial uncertainties affecting fiat currencies and government bonds.

Beyond retail investors, institutional interest in BlackRock’s Bitcoin ETF is gaining momentum. Many institutional investors view Bitcoin as a potential reserve asset, particularly amid growing concerns about inflation and government debt. The demand for alternative assets has surged globally, with significant debt accumulation prompting many investors to look toward Bitcoin.

While the future of BlackRock’s Bitcoin ETF appears promising, potential investors should remain cautious. The ongoing development of regulatory frameworks in different regions can significantly influence fund performance and Bitcoin adoption as a whole. While the ETF offers significant growth potential, it is essential for investors to consider the risks involved in cryptocurrency investments.

Despite a sluggish start to September, BlackRock’s Bitcoin ETF is still considered one of the leading vehicles for institutional Bitcoin exposure. With Bitcoin’s long-term resilience and the growing demand for safe haven assets amid financial uncertainty, the ETF could see a rebound in the coming months.

As Bitcoin continues to demonstrate its role as a unique diversifier and hedge against economic risks, BlackRock’s Bitcoin ETF is poised to attract more investors, particularly as the regulatory landscape becomes clearer.

Get more from The Bit Gazette