Ether-Bitcoin Trading Bet Leads to $43 Million Loss for Crypto Millionaire James Fickel

James Fickel, one of the wealthiest cryptocurrency investors and an early Ethereum supporter, is facing backlash after an Ether-Bitcoin trading bet resulted in losses exceeding $43 million. Fickel, who holds more than $4.8 million worth of Ether, borrowed $172 million worth of Wrapped Bitcoin (WBTC) on Jan. 10, expecting Ether to outperform Bitcoin in 2024. However, Ether’s underperformance against Bitcoin has led to spiraling debt and significant losses for the crypto millionaire.

Fickel’s Bold Ether-Bitcoin Trading Bet

Fickel’s Ether-Bitcoin trading bet was based on his long-standing confidence in Ethereum’s potential. An early investor in Ether, Fickel famously bought $400,000 worth of Ether when it was priced at just $0.80 per token. Over the years, he accumulated a fortune from his Ethereum holdings, becoming a prominent figure in the crypto world. But 2024 has proven to be a challenging year for him as his bet that Ether would surpass Bitcoin in value has backfired.

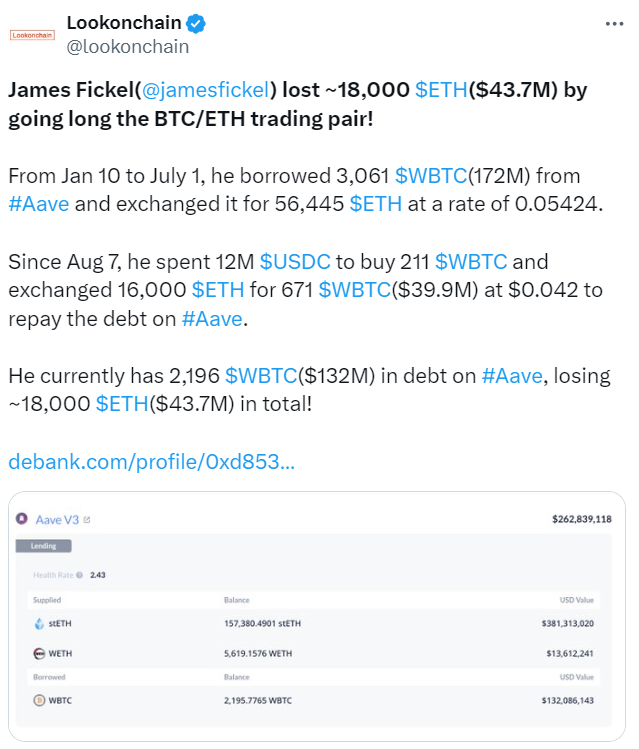

According to data from Binance, Ether’s price relative to Bitcoin has dropped by more than 24% year-to-date (YTD) and over 9% in the past month. The fall in Ether’s price, compared to Bitcoin, left Fickel in a precarious position with a growing debt on the decentralized lending platform Aave. As of September 14, Fickel’s debt had ballooned to $132 million worth of WBTC, according to data from Debank.

“James Fickel’s Ether-Bitcoin trading bet was a high-risk strategy that reflected his strong belief in Ether’s future,” said crypto analyst Rebecca Jarvis. “Unfortunately for him, the market didn’t move in his favor, and his losses highlight the dangers of leveraged positions in highly volatile markets like crypto.”

How the Ether-Bitcoin Trading Bet Worked

Fickel’s strategy involved borrowing Bitcoin to purchase more Ether. By doing this, he effectively took a short position on Bitcoin, betting that Ether’s price would rise relative to Bitcoin. If Ether had outperformed Bitcoin, Fickel could have profited significantly, paying back the Bitcoin he borrowed at a lower relative value. However, Ether’s continuous underperformance against Bitcoin meant that Fickel’s debt increased as the price ratio between the two cryptocurrencies worsened for him.

This Ether-Bitcoin trading bet is a prime example of the risks associated with decentralized finance (DeFi) platforms like Aave, where investors can take highly leveraged positions. As the value of Ether dropped, Fickel’s debt in WBTC surged, resulting in the current $132 million debt load.

“Leveraging crypto assets like this can amplify both gains and losses, and in Fickel’s case, the latter is painfully clear,” said Jarvis.

The Role of Ether ETFs in Fickel’s Losses

Another factor contributing to Ether’s underperformance has been the outflows from U.S. Ether exchange-traded funds (ETFs). Since the Ether ETFs launched on July 23, they have seen cumulative net outflows of $581 million, according to data from Farside Investors. Grayscale’s ETF alone accounted for over $2.7 billion in net outflows, further pressuring Ether’s price.

Investors had anticipated a significant price rally following the launch of Ether ETFs, much like the surge that Bitcoin experienced when its ETFs debuted. For Bitcoin, ETFs represented about 75% of new investments by mid-February, helping push Bitcoin past the $50,000 mark. In contrast, Ether’s ETFs failed to deliver the same level of enthusiasm, and outflows have weighed heavily on the cryptocurrency’s performance.

“Fickel’s Ether-Bitcoin trading bet suffered from not just the price drop in Ether but also from the broader macro factors affecting the market,” noted cryptocurrency researcher Tyler Vance. “The continuous outflows from Ether ETFs are a clear indication that investor confidence hasn’t been as strong as anticipated.”

Fickel’s Legacy as an Early Ether Investor

Despite the losses incurred by his Ether-Bitcoin trading bet, Fickel remains a significant figure in the crypto world. He founded the Amaranth Foundation, a longevity research firm, and is well-known for his substantial investment in Ether when it was still in its infancy. Fickel’s initial $400,000 investment into Ether at $0.80 per token has undoubtedly earned him millions over the years, despite his recent losses.

Nevertheless, the ongoing debt on Aave serves as a stark reminder that even the most seasoned investors can fall victim to the volatile nature of the cryptocurrency markets. With Ether struggling to outperform Bitcoin, Fickel may face further challenges in managing his debt load unless there is a dramatic reversal in the Ether-Bitcoin trading ratio.

Future Outlook for Ether and Bitcoin

While Fickel’s Ether-Bitcoin trading bet has proven costly, it is not the end of the road for Ether. Many crypto analysts remain bullish on Ether’s long-term prospects, especially with the ongoing development of Ethereum’s infrastructure and the potential for increased adoption through decentralized applications (dApps) and smart contracts.

“Ethereum has a strong foundation and a bright future, but its short-term price movements are difficult to predict,” said blockchain expert Laura Shin. “Fickel’s Ether-Bitcoin trading bet may have been poorly timed, but Ether still holds enormous potential in the long run.”

As for Bitcoin, the cryptocurrency continues to benefit from its status as a safe haven during periods of economic uncertainty. With macroeconomic factors influencing both assets, the Ether-Bitcoin trading bet will remain a closely watched dynamic in the crypto market.

Get more from The Bit Gazette