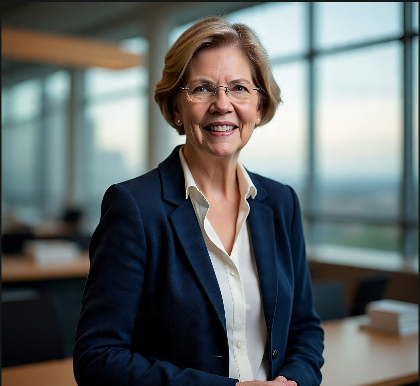

Senator Elizabeth Warren is demanding internal Federal Reserve documents to determine whether officials reduced bank supervision staffing at the request of the lenders themselves — a move she and Senator Ruben Gallego warn would be “highly inappropriate” and could explain regulatory gaps exposed by Silicon Valley Bank’s 2023 collapse.

Her request signals mounting concern in Washington that changes to Federal Reserve bank supervision could weaken safeguards designed after the global financial crisis.

In a letter co-signed with Senator Ruben Gallego, Warren warned it would be “highly inappropriate” if regulators removed examiners or softened scrutiny at the request of banks. The lawmakers argued that any recalibration of Federal Reserve bank supervision must be justified with evidence, not industry pressure.

Lawmakers Demand Transparency on Oversight Changes

At the center of the dispute is how Federal Reserve bank supervision is evolving behind closed doors. Warren wants detailed records showing who ordered staffing reductions in supervisory units, why those decisions were made, and whether they affected the Fed’s ability to detect risks before SVB’s collapse.

She also requested a timeline for a fresh internal review of the failure, which rattled markets worldwide during a brutal digital-asset downturn.

“The public deserves to know whether changes to Federal Reserve bank supervision made the system safer or simply easier for banks,” Warren said in a statement released to reporters.

Financial reform advocates echo that concern, noting that SVB’s implosion exposed gaps in monitoring interest-rate risk and liquidity.

The Fed has not publicly commented on the document request, but officials have previously said their approach to Federal Reserve bank supervision is intended to be risk-based and proportionate, meaning oversight intensity should match each institution’s size and complexity.

Regulators Rewriting the Capital Rulebook

Speaking recently about policy direction, Fed Governor Michelle Bowman outlined how regulators are revisiting several pillars that shape Federal Reserve bank supervision for major lenders. Those include annual stress tests, the supplementary leverage ratio, Basel III implementation standards, and capital surcharges for globally systemic banks.

Earlier this month, the central bank released its 2026 stress-test scenarios and published additional technical documentation explaining model design.

According to Bowman, that transparency helps firms understand exactly how Federal Reserve bank supervision measures resilience.

“Clearer information allows institutions to prepare and manage risk more effectively,” she said during conference remarks.

Last autumn, the Fed joined the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation to approve revisions to leverage rules for the largest U.S. banks.

Officials stressed that the ratio is meant to act as a safety backstop, not discourage low-risk activities such as holding U.S. Treasurys. The move marked another step in recalibrating Federal Reserve bank supervision to balance stability with market liquidity.

Political Divide Over Regulatory Philosophy

Debate over Federal Reserve bank supervision has sharpened along party lines. Some policymakers aligned with former President Donald Trump argue that post-2008 reforms burden lenders and curb economic expansion.

Investor Scott Bessent has said in interviews that excessive capital constraints can limit credit growth, reflecting a broader view among deregulatory advocates.

Progressives counter that scaling back safeguards risks repeating past crises. Warren maintains that strong Federal Reserve bank supervision is essential to protect depositors and taxpayers. “Weak oversight is what allows preventable failures to happen,” she said in a recent Senate hearing.

The dispute arrives as global economic tensions rise, including concerns about slowing consumption in China under President Xi Jinping—a factor analysts say could heighten financial-system stress and test the durability of U.S. regulatory frameworks.

Fed Signals Tailored Oversight Ahead

In separate public remarks, Bowman emphasized that tailoring is the guiding principle behind current Federal Reserve bank supervision strategy. She noted her background working at a community bank and later as a state regulator shapes her view that smaller lenders should not face identical compliance burdens as megabanks.

“Regulation should reflect actual risk,” Bowman told attendees at a banking conference, adding that community institutions generally pose less systemic threat but still require prudent monitoring.

The Fed is reviewing merger-approval processes, new-bank charter applications, and competitive-analysis methods—steps she said will refine Federal Reserve bank supervision without sacrificing safety.

Regulators are also evaluating proposed updates to the community bank leverage ratio. The aim, Bowman explained, is to give smaller lenders more flexibility while keeping capital requirements nearly twice the minimum threshold.

Officials are simultaneously reassessing the mutual-bank capital framework to ensure Federal Reserve bank supervision maintains both resilience and adaptability.

For Warren and her allies, however, assurances alone are not enough. They insist that only full disclosure of internal deliberations will clarify whether recent shifts in Federal Reserve bank supervision strengthen or dilute the guardrails meant to prevent another SVB-style shock.

As Congress awaits the Fed’s response, the clash underscores a pivotal question for U.S. finance: can evolving Federal Reserve bank supervision keep pace with a rapidly changing banking landscape without repeating the oversight lapses that history has already exposed?