Current Bitcoin Cash Price Volatility Could Drive BCH in Either Direction - Analysts

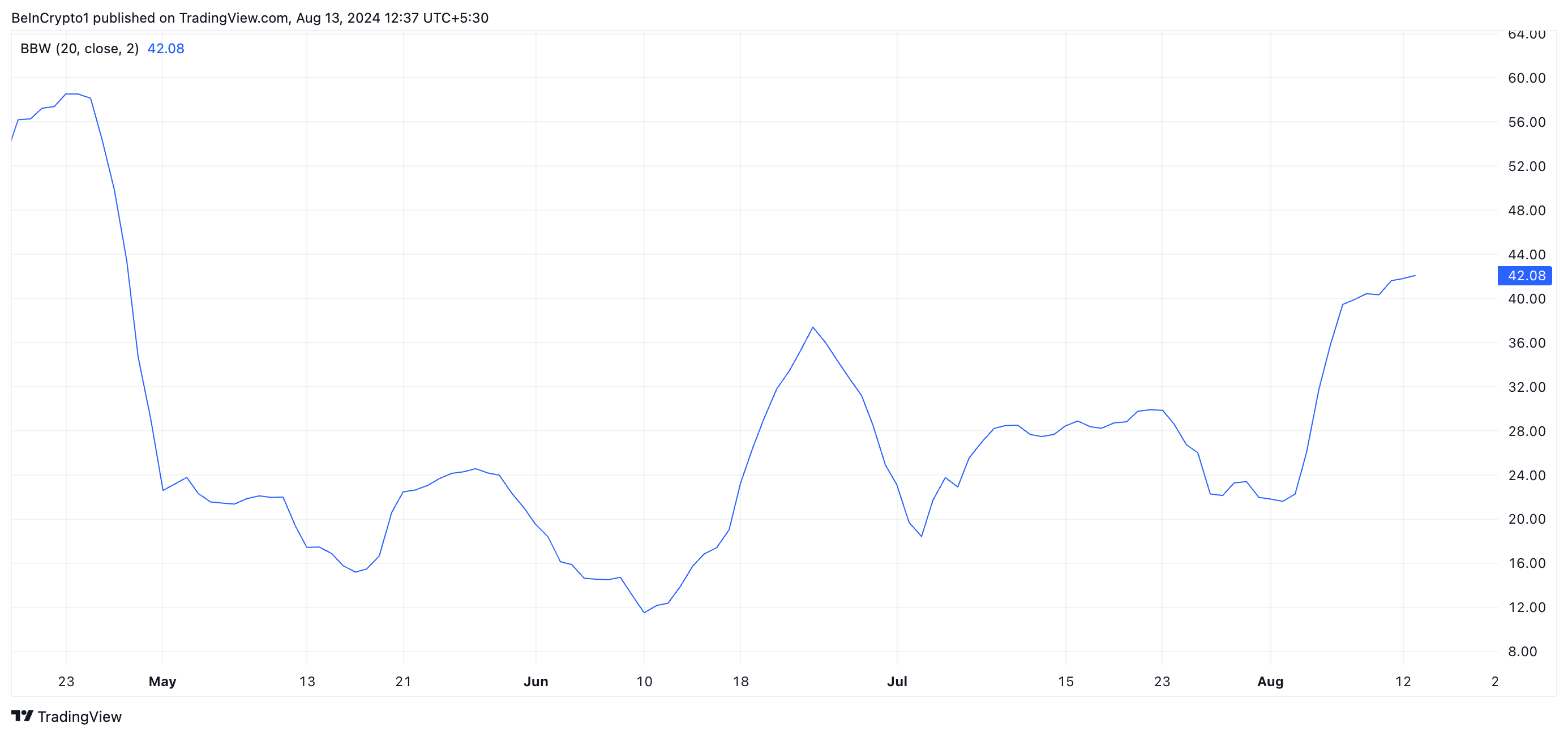

The recent Bitcoin Cash price volatility has triggered a neither-here-nor-there prediction for BCH, as indicated by the widening of its Bollinger Bands (BB), a technical analysis tool used to measure market volatility.

As of the latest trading data, Bitcoin Cash is hovering around $349.68. Over the past week, BCH has remained in a narrow price range, but the growing Bitcoin Cash price volatility suggests that this stability may not last much longer.

Bitcoin Cash Price Volatility: Indicators Point to Potential Price Swings

According to data from TradingView, he widening of the Bollinger Bands around BCH signals that the asset is becoming increasingly volatile, leaving the door open for significant price movements in either direction. This is a cause for concern among traders, as increased volatility often precedes major market moves. The current state of Bitcoin Cash price volatility has prompted analysts to closely monitor key technical indicators that may hint at BCH’s next move.

One such indicator is the Death Cross, where the 50-day moving average crosses below the 200-day moving average, a bearish signal that often foreshadows further price declines. Adding to the bearish sentiment, the Parabolic SAR (Stop and Reverse) indicator, which tracks price trends, has also turned negative, suggesting that BCH could be headed for a downward trajectory.

“If the current selling pressure on BCH persists, we could see the price drop to around $272.70,” warns crypto analyst Marcus Holloway. “However, if the market sentiment shifts and buyers regain control, we might witness a rally towards the $378.10 mark.”

Market Sentiment and Potential Outcomes

The current state of Bitcoin Cash price volatility has left the market divided. On one hand, some traders believe that the bearish indicators will lead to further declines, while others argue that BCH could bounce back if the broader market conditions improve. This split sentiment is reflected in the ongoing tug-of-war between bulls and bears, as both sides vie for control of the market.

“Volatility is a double-edged sword,” says financial expert Sarah Williams. “While it can lead to significant gains, it also comes with the risk of substantial losses. The key for traders is to manage their risk effectively and stay informed about the latest market developments.”

The crypto market is known for its unpredictability, and Bitcoin Cash price volatility is no exception. Factors such as global economic conditions, regulatory changes, and technological advancements could all play a role in determining BCH’s future price movements.

The Broader Implications of Bitcoin Cash Price Volatility for the Crypto Market

The heightened Bitcoin Cash price volatility is not just a concern for BCH holders; it also has broader implications for the cryptocurrency market as a whole. Increased volatility in one major cryptocurrency can often spill over into others, creating a ripple effect that impacts the entire market.

As traders and investors navigate this turbulent period, many are turning to technical analysis tools and market sentiment indicators to guide their decisions. However, with Bitcoin Cash price volatility reaching new heights, the future remains uncertain.

What the Future Holds for Bitcoin Cash

Looking ahead, the outlook for BCH remains uncertain. The increased Bitcoin Cash price volatility suggests that the asset could experience sharp price swings in the near future. Whether these swings will result in gains or losses largely depends on how the market reacts to the current technical signals and broader economic factors.

“In the short term, we could see BCH testing its support levels around $272.70,” says crypto trader James Carter. “But if we get a breakout to the upside, the $378.10 resistance level could come into play.”

For now, all eyes are on the market as traders await the next move in BCH. The only certainty is that Bitcoin Cash price volatility will continue to be a key factor in shaping the asset’s future.

In conclusion, the recent surge in Bitcoin Cash price volatility has made BCH a focal point in the crypto market. With key indicators suggesting potential price swings in either direction, traders and investors must stay vigilant and be prepared for any outcome. Whether BCH will rise to new heights or face further declines remains to be seen, but one thing is clear: the coming days will be crucial for the future of Bitcoin Cash.

The Bit Gazette has the latest crypto news and expert analysis.