FBI arrests Nigerian ‘tech queen’ Sapphire Egemasi in $1.3M heist targeting U.S. government

06/05/2025 - Updated On 06/17/2025

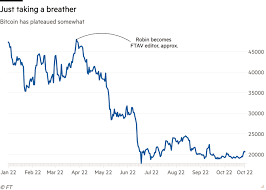

Bitcoin (BTC) hovers around the $64,000 mark amid a potential Bitcoin price stability challenge, with the market closely watching upcoming U.S. economic events. Traders and investors are on high alert, anticipating how the latest data could impact Bitcoin’s price, potentially stabilizing it or triggering major volatility. The crypto community is keenly focused on this challenge, as it could significantly influence the broader market landscape.

The first significant event in this week’s economic lineup is the release of the US Consumer Confidence Index by the Conference Board on Tuesday, August 27. This index is a critical measure of consumer attitudes toward the economy, and its results can have far-reaching effects on financial markets, including cryptocurrencies.

High consumer confidence usually signals robust spending, which can fuel economic growth. In turn, this optimism could extend to higher-risk investments like Bitcoin. On the other hand, if consumer confidence dips, it could prompt the Federal Reserve to maintain its dovish stance, potentially leading to increased liquidity in the financial system—a scenario that might support Bitcoin’s role as an alternative store of value.

“Consumer confidence is a barometer of the economy’s current and future trajectory,” says John Doe, Senior Economist at XYZ Financial. “Given Bitcoin’s sensitivity to macroeconomic factors, a strong or weak consumer confidence report could either boost or challenge Bitcoin price stability.”

On Thursday, August 29, all eyes will turn to the initial jobless claims report. This data provides insight into the health of the US labor market, a key factor in the Federal Reserve’s monetary policy decisions.

Last week’s report showed a slight increase in jobless claims, rising by 4,000 to a seasonally adjusted 232,000. This upward trend is expected to continue, with economists projecting 234,000 new claims this week. If the numbers surpass expectations, it could signal economic instability, leading investors to flock to Bitcoin as a hedge against traditional assets.

However, a decrease in jobless claims might boost confidence in the traditional markets, potentially diverting capital away from Bitcoin and posing a Bitcoin price stability challenge. As the Federal Reserve closely monitors labor conditions, these figures will be pivotal for market sentiment.

“Bitcoin’s correlation with macroeconomic data like jobless claims underscores its growing relevance as a financial asset,” notes Jane Smith, a cryptocurrency analyst at ABC Crypto Research. “Higher-than-expected claims could drive demand for Bitcoin, as investors seek safety amid economic uncertainty.”

The second revision of the Gross Domestic Product (GDP) data for Q2 is also set for release on Thursday. GDP is a vital measure of the nation’s economic health, and any revisions to this data could significantly impact market sentiment.

The initial report indicated a robust 2.8% annualized growth rate in Q2, exceeding the 1.4% pace in Q1. A positive revision would likely bolster investor confidence, potentially driving risk-on behavior in the markets and supporting further gains for Bitcoin. Conversely, a downward revision could dampen enthusiasm, creating headwinds for Bitcoin as investors become more cautious.

“The GDP revision is a critical data point that could either reinforce or challenge the current market narrative,” says Michael Turner, Chief Investment Officer at DEF Capital. “For Bitcoin, a stronger GDP could validate its appeal as a high-reward asset, while a weaker report might intensify the Bitcoin price stability challenge.”

In this scenario, Bitcoin could benefit as investors turn to it as an alternative store of value and inflation hedge.

The week concludes with the release of personal income, spending, and the Personal Consumption Expenditures (PCE) index on Friday. The PCE index, particularly the core PCE, is the Federal Reserve’s preferred inflation gauge and will be closely scrutinized for signs of inflationary pressures.

If personal income and spending data come in weaker than expected, coupled with a softer PCE index, it could pave the way for a more dovish stance from the Federal Reserve, potentially leading to a rate cut in September. This scenario could boost demand for riskier assets like Bitcoin, as lower interest rates often increase the appeal of alternative investments.

On the flip side, if the core PCE index surprises on the upside, indicating persistent inflation, investors might turn to Bitcoin as an inflation hedge. However, a sharp drop in spending power could reignite recession fears, dampening the demand for cryptocurrencies and posing yet another Bitcoin price stability challenge.

“Inflation data is crucial for Bitcoin, as it directly impacts monetary policy decisions,” remarks Sarah Lee, Senior Market Strategist at GHI Investments. “A lower-than-expected PCE reading could shift investor focus toward more stable assets, whereas persistent inflation might elevate Bitcoin’s status as a hedge.”

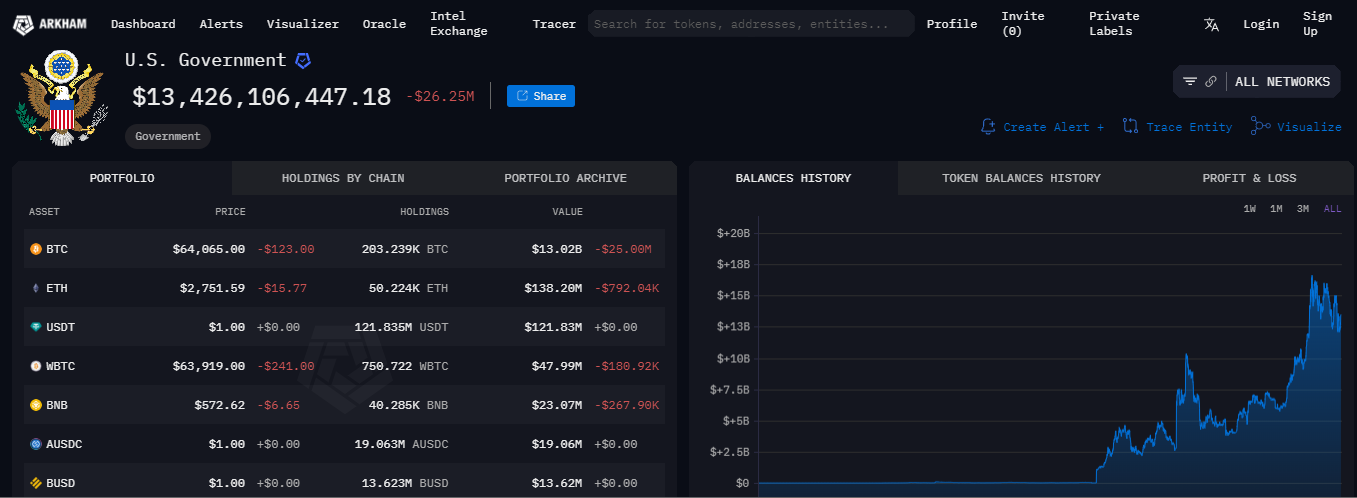

US Government Bitcoin Supply, Source: Arkham Intelligence

US Government Bitcoin Supply, Source: Arkham Intelligence

Rounding out the week is the University of Michigan’s Consumer Sentiment survey, set for release on Friday. This survey provides insights into how households perceive their financial situation, which can significantly influence market behavior.

A strong consumer sentiment report could alleviate concerns about the economy, boosting confidence in traditional markets and potentially diverting attention away from Bitcoin. Conversely, if the survey reveals that consumers are increasingly worried about inflation and job security, it could bolster Bitcoin’s appeal as a safe haven asset.

“Consumer sentiment often reflects the public’s view of the economy’s future, making it a critical factor for Bitcoin’s short-term outlook,” says Tom Brown, a market analyst at JKL Financial Services. “The sentiment data could either reinforce or challenge Bitcoin price stability as we head into the weekend.”

Adding to the Bitcoin price stability challenge is the ongoing concern over the US government’s substantial Bitcoin holdings. According to Arkham Intelligence, the government currently holds approximately 203,239 BTC. Any significant movement of this inventory could spook the market, potentially driving Bitcoin prices below the $60,000 threshold.

“The government’s Bitcoin stash is a looming threat to market stability,” warns Emily Roberts, a blockchain analyst at MNO Research. “A sudden sale could flood the market, leading to a sharp decline in prices and adding another layer of uncertainty to an already volatile environment.”

As the week progresses, the Bitcoin price stability challenge will remain a focal point for traders and investors. With several critical economic indicators on the horizon, Bitcoin’s ability to maintain its current price level will be tested. Each piece of data will contribute to the broader market narrative, potentially setting the stage for significant price movements in the days ahead. Whether Bitcoin will rise to the occasion or face renewed volatility remains to be seen. Get more from The Bit Gazette

Davidson Okechukwu is a passionate crypto journalist/writer and Web3 enthusiast, focusing on blockchain innovation, deFI, NFT ecosystems, and the societal impact of decentralized systems. His engaging style bridges the gap between technology and everyday understanding with a degree in Computer Science and various professional certifications from prestigious institutions. With over four years of experience in the crypto and DeFi space, Davidson combines his technical knowledge with a keen understanding of market dynamics. In addition to his work in cryptocurrency, he is a dedicated realtor and web management professional.