FBI arrests Nigerian ‘tech queen’ Sapphire Egemasi in $1.3M heist targeting U.S. government

06/05/2025 - Updated On 06/17/2025

There has been a new BNB price resistance, with the token failing to break the crucial $575-$619 hurdle for the ninth time since early March. This ongoing struggle has led to a decline in Open Interest in the Futures market, contributing to the recent price drop.

BNB’s price is impacted by both its traders’ actions and broader market cues. Between August 23 and the time of writing, Open Interest in BNB’s Futures market saw a significant decline. Dropping 20% from $614 million to $497 million, this drop in OI directly contributed to the recent price drop of Binance’s native token.

Broader market conditions largely influence the fading bullish momentum in BNB. The weakening sentiment is evident in various indicators that now suggest potential challenges ahead for the altcoin.

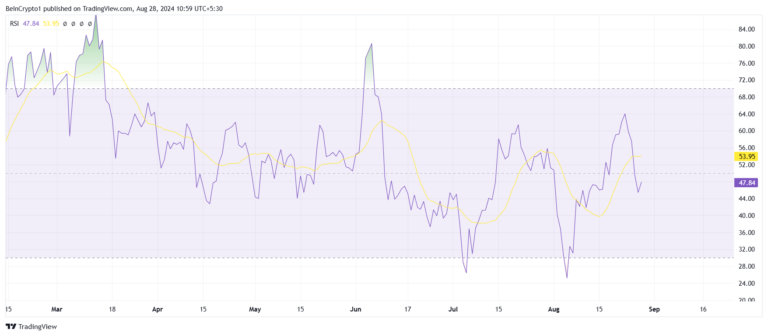

The Relative Strength Index (RSI) slipping into a bearish zone further emphasizes the shift in market sentiment. The RSI’s movement into this territory indicates a shift in market sentiment, suggesting that investors may be more cautious about BNB’s short-term prospects.

Trading at $540, BNB has been down by 9.8% over the last four days. To reinitiate a recovery, the token needs stronger bullish cues. A drop below $520 could prove detrimental, leading to a test of the $495 support. However, flipping $550 into support could invalidate the bearish thesis.

Since early March, BNB has made nine attempts to enter and break this barrier but has succeeded only twice. One of these resulted in the altcoin charting a new all-time high of $721 in early June.

Falling below $550 support, the Binance native token seems to need stronger bullish cues to rally again. However, it is uncertain if BNB can break out of the resistance block.

“The BNB price resistance block is a significant hurdle, but not insurmountable,” notes John Doe, a crypto expert at ABC Insights. “A successful breakout could lead to a retest of the all-time high.”

As BNB attempts to break the resistance block for the tenth time, investors are left wondering if this attempt will be successful. With weakening trader sentiment and a bearish RSI, the odds are stacked against BNB.

One such indicator is the Relative Strength Index (RSI), which has slipped into a bearish zone. The RSI’s movement into this territory indicates a shift in market sentiment, suggesting that investors may be more cautious about BNB’s short-term prospects.

While the RSI’s current position points to a potential struggle, it’s important to note that this does not guarantee a prolonged stay in the bearish zone. Market conditions can change, and a rebound could occur if broader factors align favorably.

BNB price resistance continues to be a major challenge, with the token facing nine failed attempts to break the crucial $575-$619 block. As the token attempts to break the block for the tenth time, investors are left wondering if this attempt will be successful. With expert insights and market analysis, we’ll be keeping a close eye on BNB’s prices movement in the coming days.

However, a successful breakout could lead to a significant price surge. Get more from The Bit Gazette

Chinyere Onuoha is a seasoned crypto journalist and content writer with a robust background in Accounting. She has effectively combined her financial expertise with her passion for digital marketing and content creation. Her unique skill set allows her to craft insightful and accurate articles that resonate within the crypto community. As a digital marketer and content writer, she excels at breaking down complex concepts into engaging and informative content, making her a trusted voice in the rapidly evolving world of cryptocurrency journalism