FBI arrests Nigerian ‘tech queen’ Sapphire Egemasi in $1.3M heist targeting U.S. government

06/05/2025 - Updated On 06/17/2025

Cardano founder Charles Hoskinson swiftly addressed recent market rumors, denouncing what he called “epic FUD” surrounding Cardano’s staking process. Known for his vocal presence in the cryptocurrency world, Hoskinson’s Cardano (ADA) price analysis comes amid growing misinformation and speculation, aiming to reassure investors and the Cardano community about the platform’s staking integrity.

However, despite his efforts to clarify the situation, Cardano (ADA) price analysis shows that the token is still on a downward trajectory, continuing to worry investors and traders alike.

The latest controversy involves prominent crypto influencers spreading false information about Cardano’s staking, leading to increased volatility and a drop in ADA’s price.

This article delves into the Cardano (ADA) price analysis, breaking down the key events, market sentiment, and price predictions for the coming weeks.

On September 11, a podcast featuring well-known crypto analysts like MartyParty, InvestAnswers, Mando, and CTO Larson sparked a heated discussion regarding Cardano.

The analysts questioned why projects like Cardano and Ripple (XRP) maintain such high market capitalizations despite lackluster price movements. One of the most controversial claims came from Mando, who stated that some investors were unable to unstake their ADA holdings, supposedly manipulating the market cap.

This statement was immediately debunked by Charles Hoskinson himself. In response, he quoted the video on X (formerly Twitter), declaring that such accusations were completely false. “The lies and misinformation about Cardano have reached epic levels. Stake isn’t locked, but they still lie. Why does anyone trust these people anymore?” Hoskinson fired back.

However, despite his prompt clarification, the Cardano (ADA) price analysis showed little to no positive impact on the token’s market performance. ADA’s price dropped from $0.35 to $0.33 within hours of the incident, further fueling bearish sentiment among traders.

Even with Hoskinson’s intervention, the Cardano (ADA) price analysis paints a gloomy picture. ADA’s price continues to trend downward, raising concerns among both retail and institutional investors.

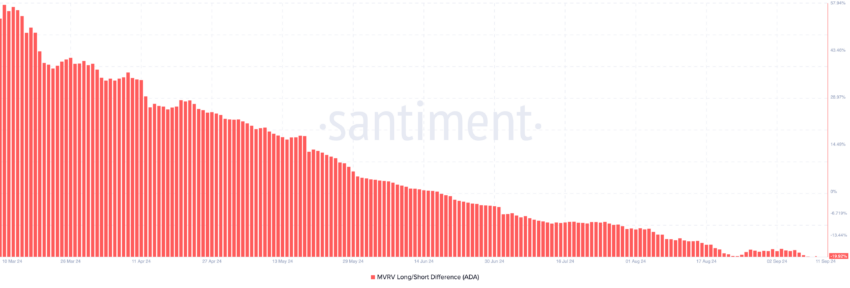

On-chain data from Santiment reveals a significant disparity in Market Value to Realized Value (MVRV). The Long/Short Difference currently stands at -19.93%, meaning short-term ADA holders have seen more unrealized profits than long-term investors. This metric is often a reliable indicator of market sentiment, and its negative reading suggests bearish conditions dominate the Cardano market.

Cryptocurrency market analyst at Santiment, Brian Quinlan, commented on the situation: “When short-term holders are in a better position than long-term holders, it generally indicates that the market is in a bearish state. Long-term holders are usually seen as the more stable hands, and when they aren’t profiting, it’s a sign of larger systemic issues.”

The Cardano (ADA) price analysis reveals that despite Charles Hoskinson addressing misinformation and dispelling FUD surrounding the project, the Cardano (ADA) price analysis remains bearish.

ADA’s price falling from $0.35 to $0.33, as on-chain data indicates negative sentiment in the Cardano (ADA) price analysis, and technical patterns suggest further declines unless strong accumulation reverses the trend, offering a potential recovery in the Cardano (ADA) price analysis if broader market conditions improve.

This negative sentiment aligns with ADA’s recent price action. Even though some investors anticipated a price surge following Hoskinson’s comments, the overall market direction has remained bearish.

Looking closely at the Cardano (ADA) price analysis, it becomes evident that the token is forming a classic technical pattern: the head-and-shoulders formation. This pattern, often regarded as a harbinger of bearish market trends, can provide significant insights into ADA’s next price movements.

A head-and-shoulders pattern typically signals a transition from a bullish to a bearish trend, as seen in ADA’s daily chart. The left shoulder formed as ADA’s price surged but then fell back to the neckline.

The head represents a higher peak, followed by another decline. Lastly, the right shoulder mirrors the first, indicating that ADA is losing momentum and could see further downward pressure.

According to cryptocurrency analyst Mike Fields, “The head-and-shoulders pattern is a widely recognized indicator of a bearish trend reversal. If ADA fails to break out of this formation, the price could dip even further in the short term.”

Fields’ analysis is supported by the Fibonacci retracement tool, which shows that ADA’s price could drop as low as $0.31 if the downtrend persists.

However, not all hope is lost for ADA bulls. Should the broader crypto market experience a resurgence, coupled with strong accumulation by long-term holders, ADA might find support around $0.31 and make a push toward $0.39.

Market Sentiment and FUD: The false information regarding Cardano’s staking process has undoubtedly impacted the market. Despite Hoskinson’s efforts to clear the air, the damage had already been done. Such FUD (Fear, Uncertainty, and Doubt) can shake investor confidence, especially in volatile markets like crypto.

Broader Market Trends: ADA’s recent price performance must also be considered within the context of the broader crypto market. Over the past few weeks, several major cryptocurrencies, including Bitcoin and Ethereum, have struggled to maintain bullish momentum. This overall market cooling has certainly played a role in ADA’s downturn.

On-chain Data: As mentioned, the MVRV Long/Short Difference indicates that short-term holders are in a better position than long-term investors. This is a red flag for ADA, as it suggests the cryptocurrency is facing selling pressure from both camps.

Technical Patterns: The head-and-shoulders pattern on ADA’s daily chart is perhaps the clearest signal of future price movement. As long as ADA stays within this formation, the downtrend could persist, making $0.31 a realistic target for the near term.

The Cardano (ADA) price analysis points to continued bearishness in the short term. Despite Charles Hoskinson’s efforts to dispel the latest wave of FUD, market sentiment has remained largely negative. The head-and-shoulders pattern, combined with unfavorable on-chain data, suggests that ADA’s price could dip further before a recovery takes shape.

That said, there is potential for a rebound if the broader crypto market begins to rally or if Cardano sees increased accumulation from long-term holders. Investors will need to watch key support levels, particularly around $0.31, to determine whether ADA can break out of its current downtrend.

As always, in the world of cryptocurrency, nothing is set in stone. For now, it’s a waiting game to see whether Cardano can shake off the bearish sentiment and stage a comeback. The Bit Gazette has the latest crypto news and expert analysis.

Davidson Okechukwu is a passionate crypto journalist/writer and Web3 enthusiast, focusing on blockchain innovation, deFI, NFT ecosystems, and the societal impact of decentralized systems. His engaging style bridges the gap between technology and everyday understanding with a degree in Computer Science and various professional certifications from prestigious institutions. With over four years of experience in the crypto and DeFi space, Davidson combines his technical knowledge with a keen understanding of market dynamics. In addition to his work in cryptocurrency, he is a dedicated realtor and web management professional.