FBI arrests Nigerian ‘tech queen’ Sapphire Egemasi in $1.3M heist targeting U.S. government

06/05/2025 - Updated On 06/17/2025

Hong Kong’s Bitcoin exchange-traded funds (ETFs) have crossed a significant threshold, with their total asset management scale surpassing HK$2 billion ($256 million). This milestone, driven largely by the efforts of OSL, one of the leading digital asset trading platforms, marks a pivotal moment in Hong Kong’s evolving cryptocurrency landscape. However, while this achievement underscores growing interest in digital assets within the region, questions linger about whether Hong Kong Bitcoin ETFs can truly compete on the global stage.

The rise of Hong Kong Bitcoin ETFs is a testament to the increasing confidence in digital assets among both retail and institutional investors. According to recent data from SoSo Value, the three spot Bitcoin ETFs in Hong Kong saw a net inflow of approximately 247 BTC this week alone, bringing their total holdings to around 4,450 BTC. This represents a weekly increase of 5.9%, with the total asset management scale now standing at approximately HK$2.113 billion.

A closer examination of the market reveals that the success of Hong Kong Bitcoin ETFs is not evenly distributed. Two of the leading ETFs, managed by China Asset Management and Harvest Asset Management, have emerged as the dominant players, commanding a combined HK$1.337 billion in assets. This accounts for over 63% of the total Bitcoin ETF market in Hong Kong. These ETFs, operated in collaboration with OSL, highlight the platform’s significant role in driving the market forward.

Rebecca Sin, a Bloomberg ETF analyst, commented on OSL’s dominance, stating, “OSL’s stronghold in the Hong Kong Bitcoin ETF market reflects a combination of investor trust and the platform’s robust operational capabilities. However, the concentration of assets within a few ETFs also points to the limited options available to investors in this market.”

The third spot Bitcoin ETF, which is unaffiliated with OSL, holds HK$776 million in assets, representing about 42% of the market. This disparity underscores the influence that OSL and its partners have in shaping the trajectory of Hong Kong Bitcoin ETFs.

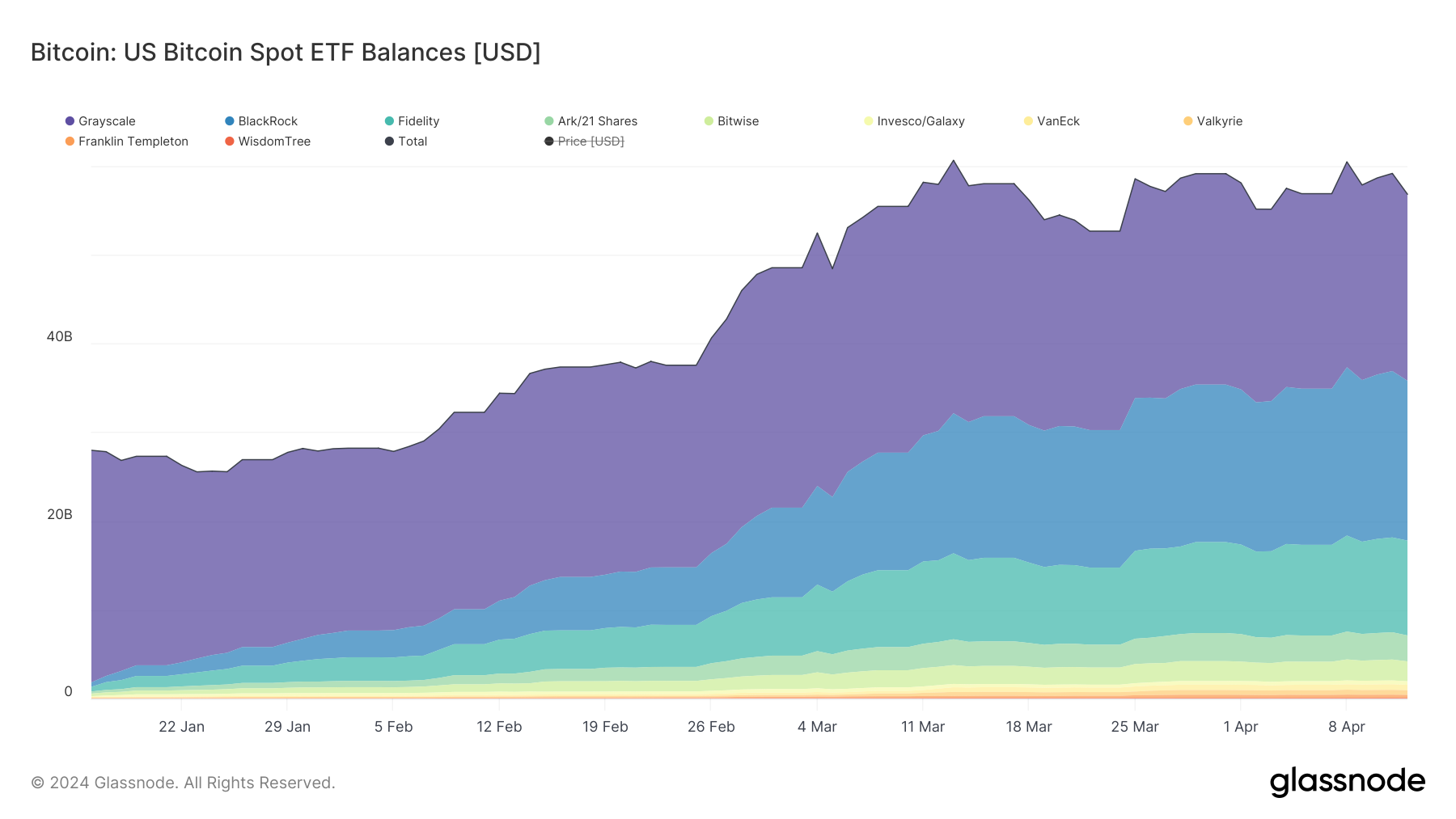

Despite the recent gains, Hong Kong Bitcoin ETFs have struggled to keep pace with their US counterparts. When these ETFs were first launched on April 30, they attracted a total of $262 million in assets under management (AUM) within the first week. However, the actual inflows during that period were a modest $14 million, a stark contrast to the billions that flowed into US spot Bitcoin ETFs earlier in January.

This discrepancy highlights the challenges Hong Kong faces in establishing itself as a global hub for cryptocurrency investments. “The Hong Kong market has potential, but it’s clear that we’re still in the early stages compared to the US,” noted Sin. “The in-kind ETF creation model in Hong Kong offers unique advantages, but we need to see a stronger inflow of capital to truly compete on a global scale.”

The performance of Hong Kong Bitcoin ETFs is further complicated by the broader economic and regulatory environment. While the city’s regulatory framework is more crypto-friendly than many other jurisdictions, the slow adoption of digital assets among local investors has hindered growth. This contrasts sharply with the US market, where a combination of strong institutional demand and favourable regulatory developments has propelled Bitcoin ETFs to new heights.

For Hong Kong Bitcoin ETFs to achieve their full potential, several key factors need to be addressed. Firstly, there is a need for greater diversity in the types of ETFs available to investors. Currently, the market is dominated by a few key players, limiting the options for investors looking to gain exposure to Bitcoin through ETFs.

Secondly, Hong Kong must work to attract more significant inflows from both retail and institutional investors. This will require not only a more aggressive marketing strategy but also a continued focus on building investor confidence in the digital asset space.

Finally, the city’s financial regulators must continue to develop a supportive framework that encourages innovation while maintaining investor protection. This balance will be crucial in ensuring that Hong Kong Bitcoin ETFs can compete with their global counterparts.

As Hong Kong’s Bitcoin ETFs continue to grow, the next few months will be critical in determining whether the city can establish itself as a leading player in the global cryptocurrency market. With OSL at the helm, there is potential for significant progress, but the road ahead is fraught with challenges.

In the words of Sin, “Hong Kong Bitcoin ETFs have come a long way, but to truly compete on the global stage, we need to see more than just incremental growth. The potential is there, but it’s up to the market and its participants to seize it.”

Hong Kong Bitcoin ETFs have made significant strides, reaching the HK$2 billion milestone, largely due to OSL’s leadership. However, to truly establish themselves as global contenders, Hong Kong Bitcoin ETFs must overcome challenges, including expanding their market share and attracting greater investor interest. The coming months will be pivotal in determining whether Hong Kong can rise to the occasion and cement its place in the global cryptocurrency landscape. The Bit Gazette has the latest crypto news and expert analysis.

Sunderland-born crypto enthusiast, cycling fanatic, and wordsmith. As co-founder and lead editor of The Bit Gazette, Mark combines his passion for blockchain with a knack for breaking down complex stories into engaging content. When he's not tracking the latest crypto trends, you'll find him on two wheels—exploring backroads or clocking miles on his favorite cycling routes. Dedicated to delivering sharp, insightful journalism in the fast-moving world of digital assets. New