FBI arrests Nigerian ‘tech queen’ Sapphire Egemasi in $1.3M heist targeting U.S. government

06/05/2025 - Updated On 06/17/2025

Ripple’s native token, XRP, is experiencing significant downward pressure, with its price currently hovering around $0.56 after a nearly 10% drop over the past week. This decline comes amid a wave of profit-taking activity, as holders increasingly cash out their gains, creating a supply-demand imbalance that has put further strain on the token’s value.

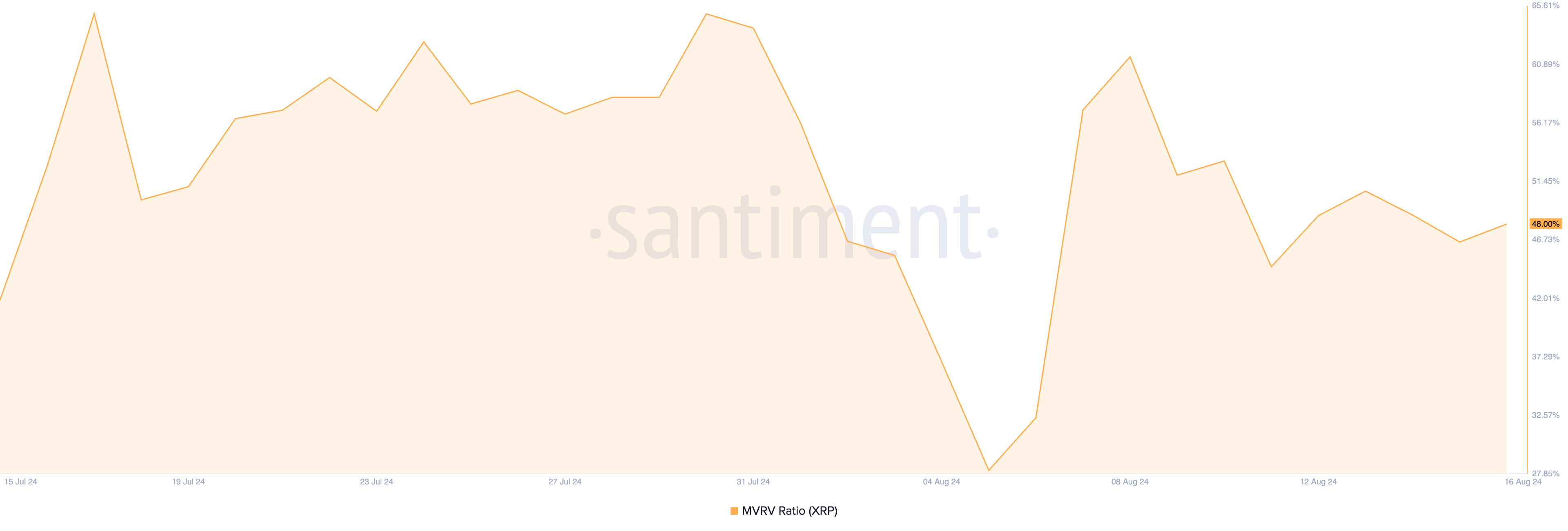

One of the key metrics driving the current XRP downward pressure is the Market Value to Realized Value (MVRV) ratio. As of now, XRP’s MVRV ratio stands at 48%, signaling that the token is overvalued. The MVRV ratio, a crucial tool for traders, compares an asset’s current market price to the average acquisition cost of its circulating supply. When this ratio exceeds one, it typically indicates that the asset is trading above its average purchase price, which often prompts holders to sell off their positions to secure profits.

“With an MVRV ratio of 48%, it’s no surprise that a significant portion of XRP holders are opting to lock in their gains,” said a market analyst at Glassnode, a leading blockchain data and intelligence provider. “This profit-taking behavior is directly contributing to the ongoing downward pressure on XRP’s price.”

The Network Realized Profit/Loss (NPL) metric has also been flashing warning signs for XRP. This metric tracks the overall profit or loss realized by traders within a specific timeframe. Since the beginning of the month, XRP’s NPL has consistently shown positive values, confirming that most traders are selling their holdings at a profit. This consistent profit realization further exacerbates the XRP downward pressure.

“When NPL values remain positive for an extended period, it typically indicates that traders are exiting their positions with substantial gains,” explained Ali Martinez, a prominent cryptocurrency analyst. “This trend, combined with a high MVRV ratio, is a classic recipe for a sustained price decline, as the market struggles to absorb the increasing sell orders.”

XRP MVRV Ratio. Source: Santiment

XRP MVRV Ratio. Source: Santiment

The XRP downward pressure is also evident in the Chaikin Money Flow (CMF) indicator, which has been in negative territory since August 11. The CMF measures the flow of money into and out of an asset’s market, and a negative CMF reading suggests that more money is flowing out than in. This is particularly concerning when paired with a falling price, as it indicates that the market is losing liquidity, a sign of potential further declines.

Additionally, since the start of the month, XRP’s Network Realized Profit/Loss (NPL) metric has consistently shown positive values, confirming that most XRP traders are selling their holdings at a profit.

“As long as the CMF remains negative, it’s unlikely that XRP will see any significant price recovery,” noted John Isige, a crypto market analyst at FXStreet. “The continuous outflow of capital from the XRP market is a strong signal that investors are losing confidence, which could push the price down to $0.52 or even lower if the trend persists.”

The current market dynamics suggest that unless XRP sees a notable spike in new demand, the XRP downward pressure is likely to continue. The liquidity exit, as evidenced by the negative CMF and high MVRV ratio, creates a challenging environment for XRP to regain its footing.

However, there is still hope for a reversal if market sentiment shifts and buyers step in to absorb the sell orders. A resurgence in demand could potentially drive XRP back up to the $0.60 level, a key psychological barrier that, if breached, could restore some confidence among investors.

“XRP needs a significant catalyst to counteract the current selling pressure,” said Michaël van de Poppe, a well-known cryptocurrency trader and analyst. “Whether it’s positive news regarding the ongoing SEC lawsuit or a broader market recovery, something needs to spark renewed interest in XRP to stabilize its price.”

The ongoing XRP downward pressure not only affects traders and investors but also has broader implications for Ripple, the company behind the cryptocurrency. Ripple has been embroiled in a legal battle with the U.S. Securities and Exchange Commission (SEC) over the classification of XRP as a security. The outcome of this case could have far-reaching effects on the future of XRP and the broader cryptocurrency market.

“If Ripple loses the lawsuit, it could lead to a significant regulatory crackdown on XRP and other cryptocurrencies,” warned legal expert Jake Chervinsky. “This uncertainty is undoubtedly contributing to the current selling pressure, as investors weigh the risks of holding XRP in such a volatile environment.”

As Ripple’s XRP faces mounting downward pressure, the market remains on edge, closely monitoring key indicators like the MVRV ratio, NPL, and CMF for signs of what’s to come. While the current outlook appears bleak, the cryptocurrency market is known for its volatility, and a sudden shift in sentiment could change the tide.

For now, however, the combination of profit-taking, declining liquidity, and regulatory uncertainty suggests that XRP may continue to struggle in the near term. Investors and traders should remain vigilant, keeping a close eye on market developments to navigate the challenges ahead. The Bit Gazette

Davidson Okechukwu is a passionate crypto journalist/writer and Web3 enthusiast, focusing on blockchain innovation, deFI, NFT ecosystems, and the societal impact of decentralized systems. His engaging style bridges the gap between technology and everyday understanding with a degree in Computer Science and various professional certifications from prestigious institutions. With over four years of experience in the crypto and DeFi space, Davidson combines his technical knowledge with a keen understanding of market dynamics. In addition to his work in cryptocurrency, he is a dedicated realtor and web management professional.